Ever wondered what truly drives the valuation of your favorite cryptocurrency? The crypto market cap isn't just a number; it's the lifeblood of digital asset evaluation, reflecting a coin's significance and potential in the vast, ever-changing crypto landscape. This exploration dives deep into the mechanics of crypto market capitalization, particularly within the context of fintechzoom.com, unraveling its importance and the forces that shape it.

The concept of crypto market capitalization is foundational. Think of it as the equivalent of a stock market's market cap, but for digital currencies. It's calculated by multiplying the current market price of a cryptocurrency by its circulating supply the total number of coins or tokens currently available to the public. This figure provides a snapshot of the total value of a cryptocurrency at a given moment, offering investors a quick and easy way to assess its relative size and influence within the broader market. Understanding market cap is critical for both seasoned traders and newcomers, serving as a benchmark for gauging investment risk and potential reward. Platforms like fintechzoom.com offer real-time updates on these values, empowering users to make informed decisions in the fast-paced world of crypto.

| Attribute | Details |

|---|---|

| Concept | Crypto Market Capitalization (Market Cap) |

| Definition | Total value of a cryptocurrency, calculated by multiplying the current price by the circulating supply. |

| Significance | Key indicator of a cryptocurrency's overall value, stability, and growth potential. Aids in comparing the relative size and importance of different coins. |

| Calculation | Market Cap = Current Price x Circulating Supply |

| Data Sources | Platforms like fintechzoom.com, CoinMarketCap, CoinGecko, CoinCodex |

| Key Uses | Assessing investment risk, comparing crypto projects, identifying market trends. |

| Market Cap Categories | Large-cap, Mid-cap, Small-cap (depending on the total value) |

| Factors Influencing Market Cap | Price fluctuations, circulating supply changes, market sentiment, news events, regulatory announcements. |

| Limitations | Can be manipulated; does not guarantee future performance. |

| Related Metrics | Trading volume, liquidity, dominance. |

| Reference Website | CoinDesk |

The crypto market cap serves as a vital tool for evaluating cryptocurrencies, offering a framework to analyze and compare various projects. It allows investors to move beyond simply looking at the price of a coin and consider its overall valuation relative to others. For instance, a cryptocurrency with a market cap of $500 million might present greater growth opportunities than one with a market cap of $50 billion, even if the price per coin is lower. This is because the smaller market cap coin has more room to grow before reaching the valuation of the larger coin. Furthermore, tracking the historical market cap of a cryptocurrency can provide insights into its past performance and potential future trajectory, helping investors assess its long-term viability.

- Unlock Remote Access Remoteiot Ssh For Raspberry Pi Free Download

- Free Remote Iot Platform Ssh Download Control Your Devices

To calculate market cap, you simply multiply the current price of a cryptocurrency by the number of coins or tokens that are in circulation. For example, if a cryptocurrency is trading at $10 per coin and there are 10 million coins in circulation, its market cap would be $100 million. This calculation is straightforward, but the implications are profound. It provides a single, easily understandable number that reflects the collective value that the market places on a particular cryptocurrency. The market cap figure is dynamic, constantly changing as the price of the cryptocurrency fluctuates and as the circulating supply increases or decreases.

Platforms like fintechzoom.com have become essential resources for staying informed about the latest cryptocurrency developments. These platforms provide not only real-time price updates and market cap figures but also in-depth analysis, news, and educational resources. They offer a comprehensive view of the crypto market, enabling users to monitor global trends, analyze historical data, and make informed investment decisions. While other platforms like CoinMarketCap and CoinGecko offer similar services, fintechzoom.com distinguishes itself through its unique approach to financial market insights, providing a blend of cryptocurrency and traditional finance perspectives.

The crypto market's rise has been nothing short of phenomenal. Over the past decade, it has transformed from a niche interest into a global phenomenon, attracting investors, traders, and technology enthusiasts from all corners of the world. This exponential growth has been fueled by a number of factors, including increasing mainstream adoption, the rise of decentralized finance (DeFi), and the growing recognition of cryptocurrencies as a legitimate asset class. However, this growth has also been accompanied by increased volatility and regulatory scrutiny, making it more important than ever for investors to have access to reliable data and analysis. This is where resources like fintechzoom.com come into play, providing users with the tools they need to navigate the complexities of the crypto market.

- Secure Remote Access Best Ssh Solutions For Iot Devices

- Meliambro Family History Origin Meaning Where They Are Today

The exponential growth of fintech innovation has significantly increased the interest in cryptocurrency market informational efficiency. Cryptocurrencies and their underlying blockchain technology represent a profound yet ambiguous aspect of fintech, challenging traditional financial models and creating new opportunities for innovation. The efficiency of information flow within the crypto market is crucial for price discovery, risk management, and overall market stability. As the market continues to evolve, the role of platforms like fintechzoom.com in providing timely and accurate information will become even more critical.

Market cap isnt just a number; it's a critical tool for analyzing and comparing cryptocurrencies. Heres how you can use it: First, understanding different market cap categories. Cryptocurrencies are often categorized based on their market cap: Large-cap (over $10 billion), Mid-cap ($1 billion to $10 billion), and Small-cap (under $1 billion). Large-cap cryptocurrencies are generally considered to be more stable and less volatile, while small-cap cryptocurrencies offer greater potential for growth but also carry higher risk. Second, risk assessment. Market cap can help you assess the risk associated with investing in a particular cryptocurrency. Larger market caps typically indicate greater liquidity and less susceptibility to price manipulation. Third, comparative analysis. Market cap allows you to compare the relative size and importance of different cryptocurrencies. This can be helpful in identifying undervalued or overvalued assets.

Fintechzoom stands out by providing comprehensive insights, analysis, and news on the current financial market. Whether youre a seasoned investor or just starting out, understanding the nuances of blockchain, cryptocurrencies, and financial technology trends has never been easier. The platform offers a wide range of resources, including real-time price updates, market cap data, in-depth articles, and video analysis. It covers not only cryptocurrencies but also traditional financial markets, providing a holistic view of the global financial landscape. This makes it a valuable tool for anyone looking to stay informed and make smart investment decisions.

Recent data from CoinGecko's 2024 annual crypto industry report highlights the significant growth of the crypto market. The total crypto market cap grew by +45.7% in Q4 2024, ending the quarter at $3.91 trillion, a staggering +97.7% increase over the entire year. Bitcoin increased its dominance, now accounting for 53.6% of the total crypto market cap. Bitcoin also outperformed major asset classes, both in 2024 overall and in Q4. This data underscores the continued growth and increasing mainstream adoption of cryptocurrencies.

In the stock market, the market cap is a measurement of a companys worth, and the crypto market cap serves a similar purpose, providing a measurement of the total value of a token. To calculate a coins market cap, you multiply its price by the number of coins it has in circulation. This simple calculation provides a powerful metric for understanding a cryptocurrencys relative weight in the market. It's an important metric for traders, as market cap is a benchmark for understanding a cryptocurrencys relative weight in the market. It refers to the total value of a cryptocurrency in circulation, which is derived by multiplying the cryptocurrencys price by the total number of coins or tokens in circulation.

Historical crypto market cap and crypto price data can be found on CoinCodex, a comprehensive platform for crypto charts and prices. After you find the cryptocurrency youre interested in on CoinCodex, such as Bitcoin, head over to the historical tab, and you will be able to access a full overview of the coins price history. This historical data can be invaluable for investors looking to identify trends and patterns in the market. It allows you to see how a cryptocurrency has performed over time, providing insights into its volatility, growth potential, and overall risk profile.

The European Union developed the Markets in Crypto Assets (MiCA) law to create a legal framework for the crypto asset market. This regulation aims to provide clarity and certainty for crypto businesses operating in the EU, as well as to protect investors from fraud and other risks. Moreover, in February 2022, the Indian government moved towards legalizing cryptocurrency by announcing a 30.0% tax on any income generated by the transfer of digital currencies. These regulatory developments highlight the growing recognition of cryptocurrencies as a legitimate asset class and the need for clear and consistent regulations to govern the market.

Whether youre interested in stocks, cryptocurrencies, or emerging trends in fintech, fintechzoom offers comprehensive coverage to help you understand market dynamics and identify potential investment opportunities. The platform provides a wealth of information, including real-time data, in-depth analysis, and expert commentary. It covers a wide range of topics, from blockchain technology and decentralized finance to artificial intelligence and the future of work. This makes it an invaluable resource for anyone looking to stay informed and make smart decisions in the ever-changing world of finance.

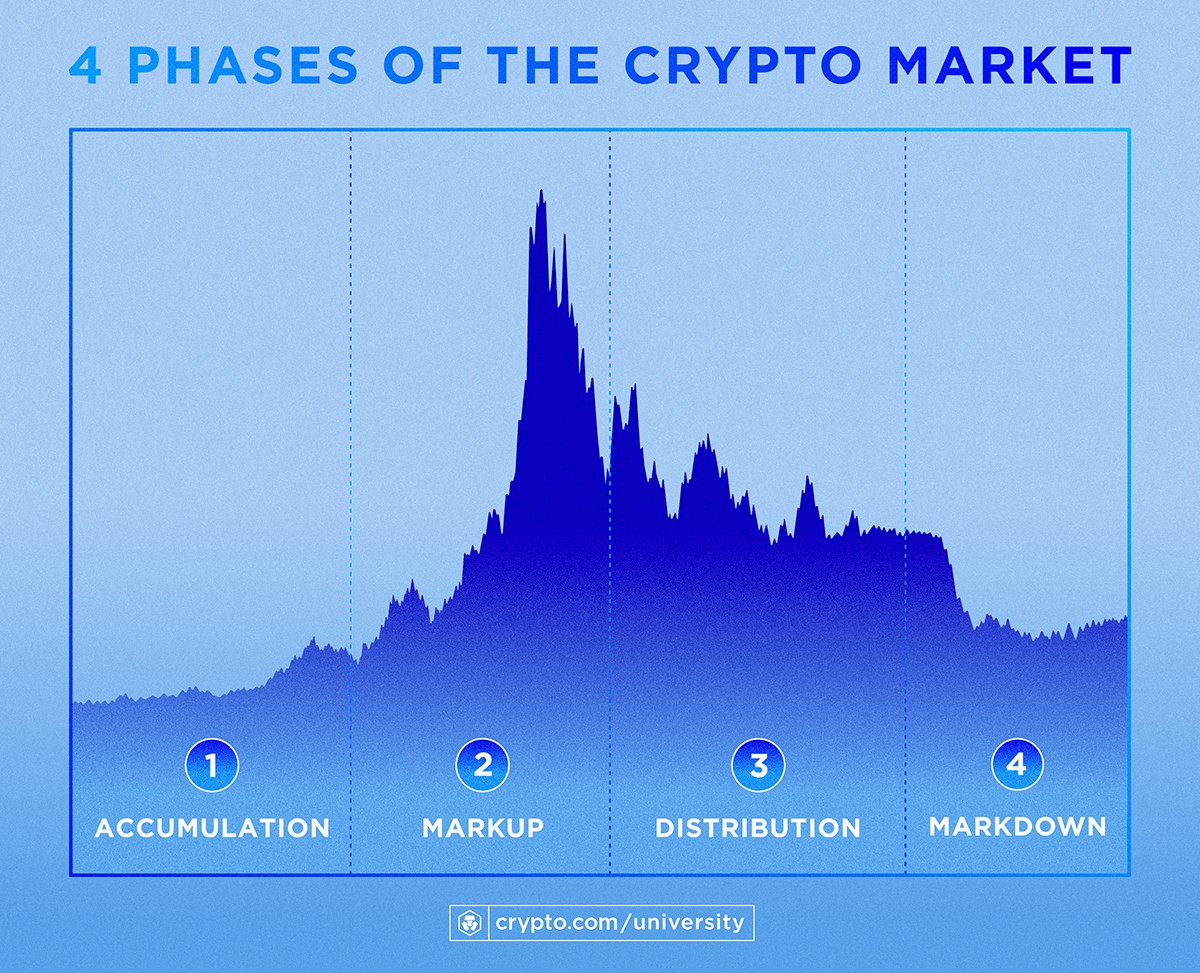

Analyzing historical data of cryptocurrency market caps provides critical insights into market trends and potential investment opportunities. For instance, observing the market cap of Bitcoin over the past decade reveals periods of exponential growth, followed by significant corrections. Understanding these historical cycles can help investors anticipate future market movements and adjust their strategies accordingly. Similarly, examining the market caps of altcoins (cryptocurrencies other than Bitcoin) can reveal emerging trends and identify promising projects with the potential for high growth.

One crucial aspect of using market cap for crypto analysis is understanding its limitations. While market cap provides a useful snapshot of a cryptocurrency's value, it is not a foolproof indicator of future performance. Market cap can be easily manipulated, particularly for cryptocurrencies with low trading volumes and concentrated ownership. Additionally, market cap does not take into account factors such as the underlying technology, the team behind the project, or the overall market sentiment. Therefore, it is essential to use market cap in conjunction with other metrics and qualitative research to make informed investment decisions.

Market sentiment plays a significant role in influencing crypto market caps. Positive news and events, such as partnerships, technological breakthroughs, or regulatory approvals, can lead to increased investor confidence and higher market caps. Conversely, negative news, such as security breaches, regulatory crackdowns, or market downturns, can trigger fear and uncertainty, leading to lower market caps. Monitoring market sentiment through social media, news outlets, and online forums can provide valuable insights into potential market movements.

The relationship between market cap and trading volume is also important to consider. High trading volume typically indicates strong investor interest and liquidity, which can support a higher market cap. Conversely, low trading volume may suggest a lack of interest or liquidity, making the cryptocurrency more susceptible to price manipulation. Analyzing the ratio of trading volume to market cap can provide insights into the strength and sustainability of a cryptocurrency's valuation.

Regulatory developments continue to be a major factor influencing the crypto market. Government regulations can have a significant impact on the adoption, usage, and valuation of cryptocurrencies. Positive regulatory developments, such as the legalization of cryptocurrencies or the establishment of clear regulatory frameworks, can boost investor confidence and lead to higher market caps. Conversely, negative regulatory developments, such as bans or restrictions on cryptocurrency trading, can trigger market sell-offs and lower market caps. Staying informed about regulatory developments in different jurisdictions is crucial for understanding the potential risks and opportunities in the crypto market.

The rise of Decentralized Finance (DeFi) has had a profound impact on the crypto market. DeFi platforms offer a wide range of financial services, such as lending, borrowing, and trading, without the need for traditional intermediaries. The growth of DeFi has led to increased demand for certain cryptocurrencies, particularly those used as collateral or governance tokens within DeFi protocols. This increased demand has, in turn, driven up the market caps of these cryptocurrencies. Understanding the dynamics of the DeFi ecosystem is essential for investors looking to capitalize on the growth of this emerging sector.

The emergence of Non-Fungible Tokens (NFTs) has also contributed to the growth of the crypto market. NFTs are unique digital assets that represent ownership of items such as art, music, or virtual real estate. The NFT market has exploded in popularity in recent years, attracting a new wave of investors and users to the crypto space. The market caps of cryptocurrencies associated with NFT platforms and marketplaces have also benefited from this growth. Staying informed about the latest trends in the NFT market can provide insights into potential investment opportunities in the broader crypto market.

The evolution of blockchain technology is another important factor to consider when analyzing crypto market caps. New blockchain innovations, such as layer-2 scaling solutions, interoperability protocols, and privacy-enhancing technologies, can improve the functionality, scalability, and security of cryptocurrencies. These technological advancements can lead to increased adoption and higher market caps. Monitoring the progress of blockchain development and identifying promising new technologies can help investors identify cryptocurrencies with the potential for long-term growth.

The competition among different cryptocurrencies is also a key factor influencing market caps. There are thousands of different cryptocurrencies, each with its own unique features, use cases, and communities. The competition for market share can be intense, with new cryptocurrencies constantly emerging and challenging established players. Understanding the competitive landscape and identifying cryptocurrencies with a strong competitive advantage is crucial for making informed investment decisions.

In conclusion, the crypto market cap is a complex and dynamic metric that reflects a wide range of factors, including price fluctuations, circulating supply, market sentiment, regulatory developments, and technological innovations. While market cap provides a useful snapshot of a cryptocurrency's value, it is essential to use it in conjunction with other metrics and qualitative research to make informed investment decisions. By staying informed about the latest trends and developments in the crypto market, investors can navigate the complexities of this emerging asset class and capitalize on the potential for long-term growth.

Detail Author:

- Name : Kathryne Batz

- Username : josefina80

- Email : dean.emmerich@hotmail.com

- Birthdate : 1985-07-18

- Address : 80648 Kuhn Wells Apt. 920 West Vivaborough, TN 92122

- Phone : 1-351-955-8533

- Company : Corwin-Bradtke

- Job : Nursing Instructor

- Bio : Consequuntur laborum et laboriosam non veritatis. Aperiam adipisci necessitatibus placeat asperiores. Sit cumque autem rerum sequi.

Socials

twitter:

- url : https://twitter.com/minerva.davis

- username : minerva.davis

- bio : Eos dolor dolores dolor sed dignissimos culpa. Aut aperiam velit harum et. Quis eum aut voluptas est modi. Minus vel voluptates nihil voluptatem rerum.

- followers : 2353

- following : 2697

instagram:

- url : https://instagram.com/minerva_davis

- username : minerva_davis

- bio : Dignissimos reiciendis modi cumque quos accusamus. Ab laborum veritatis eos. Harum vero sint sed.

- followers : 3348

- following : 1157

tiktok:

- url : https://tiktok.com/@davism

- username : davism

- bio : Id cumque optio aut nam ut voluptates. Quia molestiae dolores pariatur.

- followers : 368

- following : 2534

linkedin:

- url : https://linkedin.com/in/davism

- username : davism

- bio : Vitae qui dolor assumenda amet eveniet aut.

- followers : 6588

- following : 2987