Are we on the cusp of a seismic shift in the banking world? The impending arrival of Basel 4 signifies nothing short of a complete overhaul of global banking regulations, demanding immediate and strategic action from financial institutions worldwide.

The Basel Framework, a comprehensive suite of standards crafted by the Basel Committee on Banking Supervision (BCBS), reigns supreme as the global benchmark for the prudential regulation of banks. Its member nations have pledged to fully adopt these standards, applying them rigorously to their internationally active banks. This commitment ensures a unified approach to financial stability across borders. Back in March 2020, as the world grappled with the unprecedented challenges of the pandemic, the BCBS made a critical decision: to postpone the implementation timeline for Basel 4 by a year, pushing the effective date from January 1, 2022, to January 1, 2023. This delay offered banks a temporary reprieve, allowing them to focus on navigating the immediate crisis while simultaneously preparing for the regulatory changes on the horizon.

| Aspect | Details |

|---|---|

| Name | Basel 4 (Implementation of BCBS standards) |

| Objective | Strengthening banking regulation and supervision globally. |

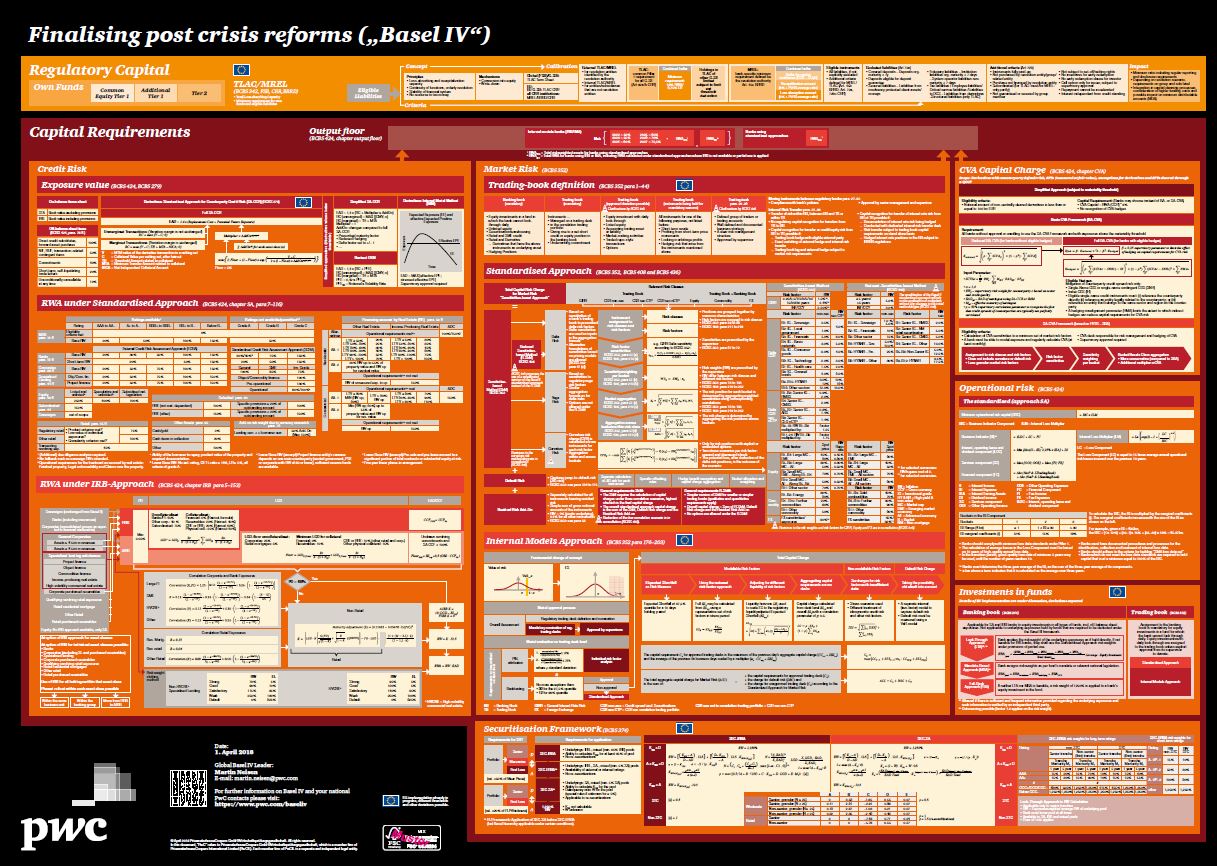

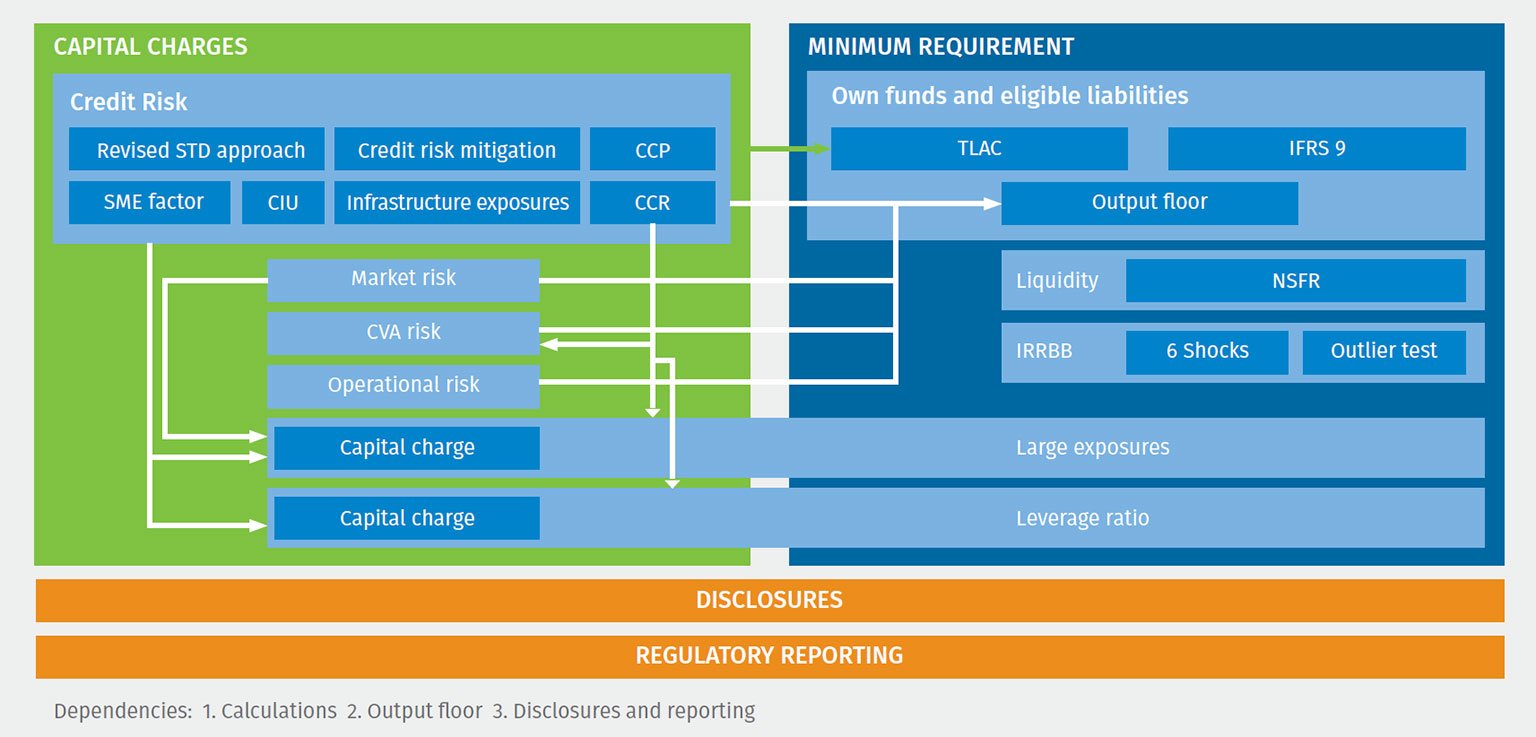

| Key Areas | Credit Risk, Operational Risk, Market Risk, Leverage Ratio, Output Floor. |

| Implementing Body | Basel Committee on Banking Supervision (BCBS) |

| Geographic Scope | International (applied by member jurisdictions to internationally active banks) |

| Implementation Date (Revised) | January 1, 2023 |

| Impact | Significant changes in capital requirements, risk management practices, and reporting standards for banks. |

| Further Information | Basel Committee on Banking Supervision Website |

The successful deployment of Basel 4 hinges on key regulatory pronouncements within the European Union (EU), the United Kingdom (UK), and the United States (US). The European Commission, for instance, was slated to unveil its CRR3 legislative proposal on October 27. CRR3, or the Capital Requirements Regulation, represents the EU's approach to incorporating Basel 4 standards into European law. However, in a divergence from the core Basel 4 principles, CRR3 introduces an amendment stipulating that the "floored" Total Risk Exposure Amount (TREA) should be applied solely by the institution at the highest level of consolidation within the EU. This nuanced approach suggests a tailored implementation strategy, acknowledging the specific characteristics of the European banking landscape. Despite this deviation, the regulation mandates that any resulting increase in required capital must be fairly distributed among subgroups located in other regions, ensuring a balanced and equitable application of the rules.

- Zak Bagans Ghost Adventures Haunted Museum Paranormal Life

- Lara Rose Birch Telegram Exclusive Content Insights

Basel 4's reach is expansive, its influence permeating nearly every facet of banking operations. The implications are far-reaching, potentially reshaping how banks manage capital, assess risk, and conduct their day-to-day business. Institutions must brace themselves for significant adjustments to their existing frameworks. KPMG stands ready to assist financial institutions in navigating the complexities of Basel 4 implementation. Their expertise encompasses a broad spectrum of services, including conducting comprehensive gap assessments and crafting detailed implementation plans. They can also help institutions anticipate and manage potential increases in capital requirements, upgrade their data infrastructure and systems, and enhance their internal and external reporting capabilities. Their support is designed to help banks transition smoothly into the new regulatory environment.

A "Basel 4 / CRR 3 primer" from Creditsights offers a valuable overview of Basel 4, elucidating its potential effects on European banks. This primer delves into the implications and impact of the new regulations, providing insights into the challenges and opportunities that lie ahead. The primer serves as a useful resource for banks seeking to understand the intricacies of Basel 4 and its potential consequences.

The revised standardized approach to market risk represents a significant shift in the regulatory landscape. The revisions focus on refining the determination of risk-weighted assets, a crucial component of capital adequacy calculations. These changes aim to improve the accuracy and consistency of risk assessments across different institutions. The Basel III framework, the predecessor to Basel 4, placed significant emphasis on banks' own funds requirements. Basel III sought to strengthen the financial resilience of banks by requiring them to hold sufficient capital to absorb potential losses. The transition to Basel 4 builds upon these earlier efforts, further enhancing the robustness of the regulatory framework.

Throughout the pandemic, banks have been called upon to play a crucial role in supporting the economy. They have been encouraged to lend to businesses and households, providing much-needed liquidity during a period of unprecedented economic disruption. This intervention highlights the importance of banks as pillars of the financial system, capable of mitigating the adverse effects of crises.

The implementation of CRR III (Capital Requirements Regulation) into European law is a critical step in ensuring the stability and resilience of the European banking system. This regulation will translate the international standards of Basel 4 into binding legal requirements for banks operating within the EU.

Basel 4 builds upon and extends the international banking accords known as Basel I and Basel II. These earlier agreements laid the foundation for international cooperation in banking supervision, establishing common standards for capital adequacy and risk management. Basel 4 represents the latest iteration of this ongoing effort to enhance the global financial system.

A KPMG analysis from September 2013 provides a valuable overview of Basel 4 and its related capital and liquidity regulatory requirements. While the analysis is from 2013, the foundational principles remain relevant, offering insights into the evolution of banking regulation over time. Developments in these areas over the past few years have further refined the regulatory landscape, making it essential for banks to stay abreast of the latest changes.

The key themes illustrated in the evolution of Basel 4 are: the continuing evolution of banking regulations and the parallel adjustments required from banks to ensure compliance and maintain financial stability. This ongoing evolution reflects the dynamic nature of the financial system and the need for constant adaptation to emerging risks.

The implementation of Basel 4 represents a significant challenge for banks, requiring them to adapt their operations, upgrade their systems, and reassess their risk management practices. The changes will likely lead to higher capital requirements for some institutions, potentially impacting their profitability and lending capacity. However, the ultimate goal of Basel 4 is to create a more resilient and stable banking system, capable of withstanding future economic shocks. This, in turn, will benefit the entire global economy.

The road to Basel 4 compliance is not without its obstacles. Banks face a number of challenges, including the complexity of the new regulations, the need for significant investments in technology and infrastructure, and the difficulty of attracting and retaining skilled personnel. However, by embracing a proactive and strategic approach, banks can navigate these challenges and successfully implement Basel 4.

One of the key areas of focus for Basel 4 is the management of credit risk. The new regulations introduce more sophisticated methods for calculating capital requirements for credit exposures, taking into account factors such as the creditworthiness of borrowers and the type of collateral held. These changes aim to ensure that banks hold sufficient capital to cover potential losses from loan defaults.

Operational risk is another area of emphasis in Basel 4. The new regulations require banks to improve their identification, assessment, and mitigation of operational risks, such as fraud, cyberattacks, and business disruptions. These changes aim to reduce the likelihood of operational losses and to enhance the resilience of banks to unexpected events.

Market risk is also addressed in Basel 4. The new regulations introduce more stringent requirements for the management of market risk, including the risk of losses from changes in interest rates, exchange rates, and commodity prices. These changes aim to ensure that banks hold sufficient capital to cover potential losses from market fluctuations.

The leverage ratio is another important component of Basel 4. The leverage ratio is a measure of a bank's capital relative to its total assets. The new regulations require banks to maintain a minimum leverage ratio, which helps to limit the amount of debt that banks can take on. This helps to reduce the risk of bank failures and to promote financial stability.

The output floor is a key element of Basel 4 that aims to limit the extent to which banks can use internal models to reduce their capital requirements. The output floor ensures that banks' capital requirements are not artificially low, which helps to maintain the overall stability of the banking system.

The successful implementation of Basel 4 requires close collaboration between banks, regulators, and other stakeholders. Banks must invest in the necessary resources and expertise to comply with the new regulations. Regulators must provide clear guidance and support to banks during the implementation process. And other stakeholders, such as investors and rating agencies, must be informed about the changes and their potential impact.

The long-term benefits of Basel 4 are significant. By strengthening the global banking system, Basel 4 will help to prevent future financial crises and to promote sustainable economic growth. The new regulations will also help to improve the efficiency and transparency of the banking sector, making it more accountable to its stakeholders.

The implementation of Basel 4 is a complex and challenging undertaking, but it is essential for the stability and prosperity of the global economy. By embracing a proactive and collaborative approach, banks, regulators, and other stakeholders can ensure that Basel 4 is successfully implemented and that its benefits are fully realized.

The implications of Basel 4 extend beyond the banking sector, impacting the broader economy. The changes in capital requirements and risk management practices will affect the availability of credit to businesses and households, potentially influencing economic growth. It is crucial for policymakers to carefully consider these implications as they implement Basel 4.

The Basel Committee on Banking Supervision (BCBS) plays a vital role in setting global standards for banking regulation. The BCBS brings together representatives from central banks and supervisory authorities around the world to develop and promote sound supervisory practices. Its work is essential for maintaining the stability of the global financial system.

The implementation of Basel 4 is a continuous process, requiring ongoing monitoring and adaptation. As the financial system evolves, the BCBS will continue to refine its standards to address emerging risks and challenges. This iterative approach ensures that the regulatory framework remains relevant and effective.

The success of Basel 4 depends not only on its technical details but also on its effective implementation and enforcement. Regulators must be vigilant in ensuring that banks comply with the new regulations and that they are held accountable for any violations. Strong enforcement is crucial for maintaining the credibility of the regulatory framework and for preventing future financial crises.

The global financial crisis of 2008 highlighted the importance of strong banking regulation and supervision. The crisis exposed weaknesses in the existing regulatory framework and led to a widespread loss of confidence in the financial system. Basel 4 is a direct response to the lessons learned from the crisis, aiming to prevent similar events from happening again.

The implementation of Basel 4 is a global effort, requiring cooperation and coordination among countries. The BCBS works closely with its member jurisdictions to ensure that the new regulations are implemented consistently across borders. This international collaboration is essential for maintaining the stability of the global financial system.

The implementation of Basel 4 is not without its critics. Some argue that the new regulations are too complex and burdensome, potentially stifling innovation and economic growth. Others argue that the regulations do not go far enough in addressing the risks facing the financial system. These debates are a healthy part of the policymaking process, ensuring that the regulatory framework is as effective and efficient as possible.

Despite the challenges and criticisms, Basel 4 represents a significant step forward in strengthening the global banking system. By improving capital adequacy, risk management, and transparency, Basel 4 will help to prevent future financial crises and to promote sustainable economic growth. The new regulations will also help to restore confidence in the financial system, encouraging investment and lending.

The transition to Basel 4 is a journey, not a destination. The implementation process will take time and effort, requiring ongoing collaboration and adaptation. But the long-term benefits of a stronger and more resilient banking system are well worth the investment. By embracing a proactive and forward-looking approach, banks, regulators, and other stakeholders can ensure that Basel 4 is successfully implemented and that its benefits are fully realized.

One of the less discussed but crucial aspects of Basel 4 is its impact on smaller, regional banks. While the focus often remains on internationally active institutions, the ripple effect of these regulations can significantly alter the competitive landscape for smaller players. These banks may face disproportionately higher compliance costs relative to their size, potentially hindering their ability to offer competitive services and support local economies. Regulators need to consider tailored approaches and provide resources to assist smaller banks in navigating the complexities of Basel 4 without stifling their growth and contribution to the financial ecosystem.

Another key consideration is the impact of Basel 4 on emerging markets. These economies often have unique banking structures and risk profiles that may not be fully captured by the standardized approaches outlined in the Basel framework. Implementing Basel 4 in these contexts requires careful calibration and adaptation to local conditions. Blindly applying the same rules across all jurisdictions could have unintended consequences, potentially undermining financial stability and hindering economic development. Dialogue and collaboration with emerging market regulators are essential to ensure that Basel 4 is implemented in a way that supports their specific needs and priorities.

The technological advancements in the financial sector are also reshaping the context in which Basel 4 is being implemented. Fintech companies and innovative technologies are disrupting traditional banking models, introducing new risks and opportunities. Regulators need to adapt their approach to Basel 4 to account for these developments, ensuring that the regulatory framework remains relevant and effective in the face of rapid technological change. This may involve exploring new regulatory tools and approaches, such as sandboxes and innovation hubs, to foster responsible innovation while mitigating potential risks.

The role of data in Basel 4 is becoming increasingly important. The new regulations require banks to collect and report vast amounts of data, which is used to assess their risk profiles and capital adequacy. However, the quality and reliability of this data are crucial for the effectiveness of Basel 4. Banks need to invest in robust data management systems and processes to ensure that the data they are reporting is accurate and complete. Regulators also need to develop effective data validation techniques to identify and address any inconsistencies or errors in the data.

The human element in Basel 4 cannot be overlooked. The successful implementation of Basel 4 requires skilled and knowledgeable professionals who understand the complexities of the regulations and are able to apply them effectively. Banks need to invest in training and development programs to equip their employees with the necessary skills. Regulators also need to attract and retain qualified supervisors who can oversee the implementation of Basel 4 and ensure that banks are complying with the regulations.

The communication of Basel 4 is essential for building trust and confidence in the financial system. Banks need to clearly communicate the changes they are making to comply with the new regulations to their customers, investors, and other stakeholders. Regulators also need to communicate the rationale behind Basel 4 and its potential benefits to the public. Open and transparent communication is crucial for fostering a shared understanding of the goals and objectives of Basel 4.

The monitoring and evaluation of Basel 4 are essential for ensuring its effectiveness. Regulators need to continuously monitor the impact of Basel 4 on the banking system and the broader economy. They also need to evaluate the effectiveness of the new regulations in achieving their intended goals. This ongoing monitoring and evaluation will allow regulators to identify any weaknesses in the regulatory framework and to make necessary adjustments to improve its effectiveness.

The sustainability of Basel 4 is a long-term consideration. The financial system is constantly evolving, and the regulatory framework needs to adapt to these changes. Regulators need to continuously monitor the financial system and to identify emerging risks and challenges. They also need to be prepared to make necessary adjustments to Basel 4 to ensure that it remains relevant and effective in the face of future changes.

The future of Basel 4 is uncertain, but one thing is clear: the global regulatory landscape will continue to evolve. Banks need to be prepared to adapt to these changes and to embrace a culture of continuous improvement. By doing so, they can ensure that they remain compliant with the regulations and that they are able to compete effectively in the global marketplace. The challenge lies in striking a balance between promoting financial stability and fostering innovation and economic growth.

Detail Author:

- Name : Cecile Kunde

- Username : zaria72

- Email : xdaugherty@nader.com

- Birthdate : 1991-09-11

- Address : 14420 Consuelo Pass South Stanford, VA 09663-0862

- Phone : +1 (650) 292-9174

- Company : Tromp, Streich and Osinski

- Job : Real Estate Association Manager

- Bio : Reiciendis quisquam commodi assumenda quis ex. Dolor nihil consequuntur illo sequi voluptatem non excepturi delectus. Ut rerum veritatis nihil velit praesentium eos.

Socials

tiktok:

- url : https://tiktok.com/@jason.haley

- username : jason.haley

- bio : Aut soluta occaecati officiis quia ducimus omnis.

- followers : 4906

- following : 464

twitter:

- url : https://twitter.com/jason_real

- username : jason_real

- bio : Non a enim quidem quaerat minima quis ea. Et cupiditate optio iste odit. Quam consequatur dolor maxime dolore velit neque nam. At nihil est illo dolore aut.

- followers : 4008

- following : 1977

instagram:

- url : https://instagram.com/jasonhaley

- username : jasonhaley

- bio : Ipsam nisi occaecati ducimus qui. Eligendi totam numquam numquam nisi rem sit dolorum.

- followers : 4645

- following : 2514

facebook:

- url : https://facebook.com/jasonhaley

- username : jasonhaley

- bio : Non maxime vel pariatur eos. Sint et qui tempora in eaque autem.

- followers : 2366

- following : 2416

linkedin:

- url : https://linkedin.com/in/jason.haley

- username : jason.haley

- bio : Omnis ut id iste distinctio nihil.

- followers : 185

- following : 595