Is the global financial system truly prepared for the next crisis? The unwavering and on-time implementation of Basel III stands as the cornerstone of a resilient and thriving banking ecosystem, essential for fostering sustainable economic resurgence and advancement.

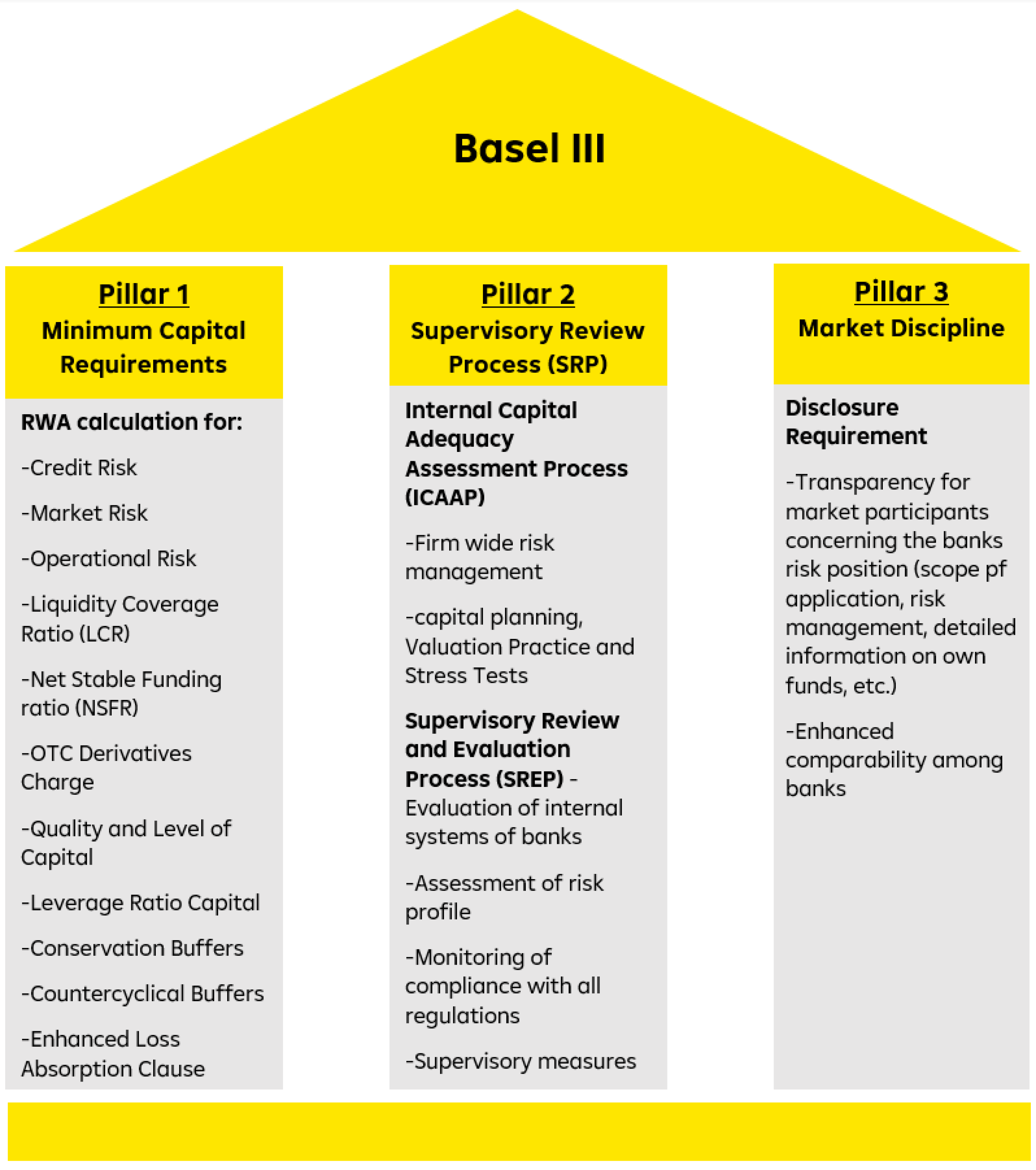

Basel III, a comprehensive suite of international banking regulations meticulously crafted by the Bank for International Settlements (BIS), is designed to fortify the international financial system's defenses against potential shocks. It aims to bolster banks' capital adequacy, improve risk management practices, and enhance transparency, ultimately reducing the likelihood of future financial meltdowns. By establishing higher capital requirements, stricter liquidity standards, and enhanced risk coverage, Basel III seeks to create a more stable and resilient banking sector capable of weathering economic storms.

| Category | Details |

|---|---|

| Name | Basel III (Basel 3) |

| Type | International Banking Regulations |

| Developer | Bank for International Settlements (BIS) |

| Objective | To promote stability in the international financial system. |

| Key Areas | Capital Adequacy, Liquidity Risk, Leverage Ratio |

| Implementation Body | Basel Committee on Banking Supervision (BCBS) |

| Original Timeline | Phased implementation starting in 2013 |

| Latest Implementation Date | July 1, 2025 (for final reforms) |

| Related Accords | Basel I, Basel II, Basel 2.5 |

| Further Information | Bank for International Settlements - Basel III |

The Basel III framework emerged as a direct response to the devastating global financial crisis of 2008. The Basel Committee on Banking Supervision (BCBS), recognizing the inherent weaknesses in the pre-crisis regulatory landscape, embarked on a mission to overhaul the existing framework and create a more robust and resilient banking system. This comprehensive overhaul, known as Basel III, addresses critical vulnerabilities exposed by the crisis, including inadequate capital buffers, excessive leverage, and insufficient liquidity.

- Discover Luke Roberts Bio Movies More The Actor From Holby City Game Of Thrones

- Miu Shiramine Info Release Date Streaming More Discover Now

Initially slated for full implementation in January 2023, the deadline for the final Basel III reforms has been extended by six months to July 1, 2025. This extension, however, is coupled with a corresponding reduction of six months in the transitional period, now spanning 4.5 years. This adjustment aims to ensure that the full implementation of Basel III is not unduly delayed, recognizing the urgency of strengthening the global financial system.

The Bank of England, in a press release dated September 27, 2023, provided insights into the "Timings of Basel 3.1 Implementation in the UK," offering further clarity on the specific implementation timeline within the United Kingdom. This underscores the ongoing efforts by national regulatory bodies to align their regulations with the Basel III framework.

On December 7, 2017, the BCBS unveiled the final regulatory standards stemming from its post-crisis Basel III reforms, as highlighted in "McKinsey on Risk Number 5" from April 2018. These standards represent the culmination of years of deliberation and refinement, incorporating lessons learned from the financial crisis and aiming to address emerging risks in the financial landscape.

- Before Surgery The Untold Story Of Ms Sethis Journey Discover Now

- Brooke Henderson Engagement Boyfriend More Latest News

Sometimes referred to as Basel IV, the new regulations that took effect in January 2023 encompass the Fundamental Review of the Trading Book (FRTB) and Basel 3.1. These components represent significant enhancements to the Basel framework, particularly in the areas of market risk and credit risk modeling. The FRTB aims to provide a more accurate and risk-sensitive assessment of trading book exposures, while Basel 3.1 focuses on refining the standardized approaches for credit risk, ensuring a more consistent and comparable application across different jurisdictions.

In 2016, the Basel Committee's Secretary General offered a contrasting perspective, suggesting that the modifications implemented at that time were not substantial enough to warrant a new designation. This highlights the ongoing debate and varying interpretations surrounding the evolution of the Basel framework, with some observers viewing the changes as incremental adjustments while others consider them to be transformative reforms.

While Basel I, II, and III officially represent the only true accords, some minor adjustments were introduced between Basel II and Basel III. These modifications, often referred to as Basel 2.5, addressed specific shortcomings identified in Basel II, particularly in the areas of securitization and trading book risk. Basel 2.5 served as an interim step towards the more comprehensive reforms embodied in Basel III.

Basel 2.5, therefore, was a revision of certain aspects of Basel II, aiming to enhance the framework's sensitivity to risk and address emerging vulnerabilities in the financial system. These revisions included increased capital requirements for certain types of exposures, enhanced disclosure requirements, and refinements to the methodologies for calculating risk-weighted assets.

The international regulatory framework for the banking sector, known as the "Cadre rglementaire international du secteur bancaire (Ble III)," has now fully integrated the Basel III reforms into the consolidated Basel framework. This framework encompasses all current and future standards set by the Basel Committee on Banking Supervision (BCBS), ensuring a comprehensive and consistent approach to prudential regulation across the globe.

The Basel framework represents the complete set of standards issued by the Basel Committee on Banking Supervision (BCBS), which serves as the primary global standard setter for the prudential regulation of banks. The BCBS plays a crucial role in promoting financial stability by developing and disseminating best practices for bank supervision and regulation.

The members of the BCBS have committed to fully implementing these standards and applying them to the internationally active banks within their respective jurisdictions. This commitment underscores the global consensus on the importance of Basel III in strengthening the financial system and preventing future crises.

This document outlines the Basel Committee's finalization of the Basel III framework, providing a comprehensive overview of the key reforms and their objectives. It serves as a valuable resource for policymakers, regulators, and industry practitioners seeking to understand and implement the Basel III standards.

It complements the initial phase of Basel III reforms previously finalized by the Committee, building upon the existing framework and addressing emerging challenges in the financial landscape. The Basel III framework is an evolving set of regulations that is constantly being refined and updated to reflect the latest developments in the financial industry.

The Basel Accord encompasses a series of agreements on banking regulations concerning capital risk, market risk, and operational risk. These agreements aim to ensure that banks maintain adequate capital to absorb unexpected losses, manage market risks effectively, and mitigate operational risks arising from internal processes and external events.

The Basel Accords, consisting of three agreements, are designed to mitigate the risks associated with banking and financial institutions. These accords represent a collective effort by international regulators to promote financial stability and prevent systemic crises.

The accords determine whether a bank possesses sufficient reserves to withstand unforeseen losses. This is a critical aspect of prudential regulation, as it ensures that banks have the financial capacity to weather economic downturns and maintain their solvency.

The Basel Committee on Banking Supervision (BCBS), the architect of the Basel Accords, continues to monitor and refine the framework to address emerging risks and vulnerabilities in the global financial system. The committee's ongoing work is essential for maintaining the stability and resilience of the international banking sector.

The implementation of Basel III is not without its challenges. Banks face significant costs in adapting their systems and processes to comply with the new regulations. Regulators must also ensure that the implementation is consistent and effective across different jurisdictions, avoiding regulatory arbitrage and maintaining a level playing field.

Despite these challenges, the benefits of Basel III outweigh the costs. A stronger and more resilient banking system is essential for supporting economic growth and preventing future financial crises. The Basel III framework represents a significant step forward in achieving this goal.

The Basel Accords have had a profound impact on the banking industry, shaping the way banks manage their capital, risk, and operations. The accords have contributed to a more stable and resilient financial system, reducing the likelihood of future crises.

The Basel framework is not a static set of rules, but rather an evolving framework that is constantly being refined and updated to reflect the latest developments in the financial industry. The BCBS continues to monitor and assess the effectiveness of the Basel Accords, making adjustments as necessary to address emerging risks and vulnerabilities.

The future of the Basel framework is likely to involve further enhancements to address new challenges, such as the rise of fintech and the increasing complexity of financial markets. The BCBS will continue to play a crucial role in shaping the future of banking regulation, ensuring that the financial system remains stable and resilient in the face of evolving risks.

In conclusion, the Basel Accords, particularly Basel III, represent a critical framework for promoting stability and resilience in the global financial system. The ongoing implementation and refinement of these accords are essential for preventing future crises and supporting sustainable economic growth. The collaborative efforts of international regulators and the commitment of banks to comply with the Basel standards are vital for maintaining a healthy and robust financial sector.

The complexities surrounding Basel III implementation also touch upon the nuances of national interpretations and adaptations. While the core principles remain consistent, individual countries often tailor the regulations to suit their specific economic and financial contexts. This can lead to variations in implementation timelines, capital requirements, and supervisory practices.

For instance, some jurisdictions may adopt a more conservative approach, imposing stricter capital buffers or implementing the regulations ahead of schedule. Others may opt for a more gradual transition, providing banks with additional time to adjust their balance sheets and operations. These variations can create both opportunities and challenges for banks operating across multiple jurisdictions.

Furthermore, the interaction between Basel III and other regulatory frameworks, such as national resolution regimes and macroprudential policies, adds another layer of complexity. These frameworks are designed to complement Basel III, providing additional safeguards against systemic risk and ensuring that banks can be resolved in an orderly manner if they fail.

The success of Basel III ultimately depends on the effective coordination and collaboration between national regulators. The BCBS plays a crucial role in fostering this collaboration, providing a forum for regulators to share best practices and address common challenges. Through ongoing dialogue and cooperation, regulators can ensure that the Basel III framework is implemented consistently and effectively across the globe.

The economic impact of Basel III is a subject of ongoing debate. Some economists argue that the higher capital requirements imposed by Basel III could constrain lending and slow economic growth. Others contend that a more stable and resilient banking system is essential for long-term economic prosperity.

Empirical studies on the impact of Basel III have yielded mixed results. Some studies have found evidence that Basel III has led to a reduction in lending growth, while others have found little or no impact. The overall economic impact of Basel III is likely to depend on a variety of factors, including the specific implementation of the regulations, the health of the economy, and the behavior of banks.

Despite the uncertainty surrounding the economic impact of Basel III, there is broad consensus that the framework has made the banking system safer and more resilient. The higher capital requirements and stricter liquidity standards have reduced the likelihood of bank failures and lessened the potential for systemic crises.

The financial industry has also adapted to the Basel III framework, developing new risk management tools and strategies to comply with the regulations. Banks have invested heavily in technology and personnel to improve their risk modeling capabilities and ensure that they meet the capital and liquidity requirements.

The innovation of financial technology (FinTech) also presents both opportunities and challenges for the Basel III framework. FinTech firms are disrupting traditional banking models, offering new and innovative financial services. Regulators must adapt to these changes, ensuring that FinTech firms are subject to appropriate regulation while also fostering innovation and competition.

The increasing complexity of financial markets also poses a challenge for the Basel III framework. New financial instruments and trading strategies are constantly emerging, requiring regulators to stay ahead of the curve and ensure that the regulations are comprehensive and effective. The BCBS is continuously monitoring the financial markets, identifying emerging risks and vulnerabilities and developing new regulatory standards to address them.

The Basel III framework represents a significant achievement in international banking regulation. The framework has made the financial system safer and more resilient, reducing the likelihood of future crises. However, the implementation of Basel III is an ongoing process, and regulators must continue to monitor and refine the framework to address emerging risks and vulnerabilities.

The role of supervisory judgment in the implementation of Basel III cannot be overstated. While the regulations provide a clear framework for capital adequacy, risk management, and liquidity, the ultimate responsibility for ensuring that banks are operating safely and soundly rests with the supervisory authorities. Supervisors must exercise their judgment in assessing the specific risks faced by each bank and in determining whether the bank's capital and risk management practices are adequate.

Effective supervisory judgment requires a deep understanding of the bank's business model, its risk profile, and the overall economic environment. Supervisors must also be able to identify emerging risks and vulnerabilities and to take prompt corrective action when necessary. The BCBS provides guidance and training to supervisors around the world, helping them to develop the skills and expertise needed to exercise sound supervisory judgment.

The interplay between quantitative rules and qualitative judgment is a key feature of the Basel III framework. The quantitative rules provide a baseline for capital adequacy and risk management, while the qualitative judgment allows supervisors to tailor the regulations to the specific circumstances of each bank. This combination of rules and judgment ensures that the regulations are both comprehensive and flexible.

The governance of banks also plays a crucial role in the effectiveness of Basel III. Banks with strong governance structures are more likely to comply with the regulations and to manage their risks effectively. Effective governance includes a clear separation of duties between the board of directors and management, strong internal controls, and a robust risk management function.

The board of directors is responsible for overseeing the bank's strategy, risk management practices, and compliance with regulations. The board must have the skills and expertise needed to understand the bank's business model and its risk profile. The board must also be independent from management and must be able to challenge management's decisions when necessary.

The management team is responsible for implementing the bank's strategy and managing its risks on a day-to-day basis. The management team must have the skills and experience needed to manage the bank's operations and to comply with regulations. The management team must also be accountable to the board of directors for its performance.

The Basel III framework also addresses the issue of systemic risk, which is the risk that the failure of one bank could trigger a cascade of failures throughout the financial system. Systemic risk is a major concern for regulators, as it can lead to widespread economic disruption.

Basel III includes a number of measures to reduce systemic risk, including higher capital requirements for systemically important banks, enhanced supervision of systemically important banks, and the development of resolution regimes for systemically important banks. These measures are designed to ensure that systemically important banks are more resilient and that they can be resolved in an orderly manner if they fail.

The Basel III framework also promotes greater transparency in the banking system. Banks are required to disclose more information about their capital, risk exposures, and risk management practices. This transparency helps to improve market discipline and to reduce the potential for moral hazard.

The greater transparency also allows regulators to better assess the risks faced by banks and to take prompt corrective action when necessary. The BCBS has developed a set of disclosure standards that are designed to promote comparability across different jurisdictions.

The implementation of Basel III is a complex and ongoing process. However, the framework represents a significant step forward in promoting stability and resilience in the global financial system. The collaborative efforts of international regulators and the commitment of banks to comply with the Basel standards are vital for maintaining a healthy and robust financial sector. The framework continues to evolve to address new challenges and complexities in the financial landscape, ensuring its relevance and effectiveness in the years to come.

:max_bytes(150000):strip_icc()/basell-iii-final-dac3d358ac6847b2b8387ba62d15eb26.jpg)

Detail Author:

- Name : Ms. Leslie Donnelly I

- Username : lorena.wuckert

- Email : abshire.victoria@towne.com

- Birthdate : 1981-03-01

- Address : 19622 Jennyfer Square Bahringerview, AR 66091-8404

- Phone : +1-901-286-3224

- Company : Hirthe, Howell and Maggio

- Job : Silversmith

- Bio : Molestiae veritatis doloribus qui rem. Animi rerum non cum sapiente. Sit reiciendis velit labore earum officia.

Socials

instagram:

- url : https://instagram.com/beau.kessler

- username : beau.kessler

- bio : Quaerat ab sint molestiae nemo. Voluptate et facilis consequatur.

- followers : 4353

- following : 982

linkedin:

- url : https://linkedin.com/in/bkessler

- username : bkessler

- bio : Inventore aut voluptas sed.

- followers : 4504

- following : 2104

tiktok:

- url : https://tiktok.com/@beau_kessler

- username : beau_kessler

- bio : Molestiae rerum quia eum dolorem repellendus officia ad.

- followers : 5188

- following : 2523